All Categories

Featured

Table of Contents

The are entire life insurance policy and global life insurance coverage. expands money value at an assured rates of interest and also via non-guaranteed returns. expands cash worth at a dealt with or variable price, depending on the insurance provider and policy terms. The money value is not included to the survivor benefit. Cash money worth is a feature you benefit from while alive.

The plan funding interest rate is 6%. Going this route, the passion he pays goes back into his plan's money worth instead of a financial organization.

Infinite Banking Insurance

The idea of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a money specialist and follower of the Austrian college of economics, which promotes that the value of products aren't clearly the result of conventional economic frameworks like supply and demand. Rather, individuals value cash and goods differently based upon their financial condition and requirements.

One of the risks of conventional financial, according to Nash, was high-interest prices on fundings. A lot of individuals, himself consisted of, got into monetary difficulty because of dependence on financial organizations. As long as financial institutions set the rates of interest and car loan terms, individuals really did not have control over their own riches. Becoming your own banker, Nash identified, would certainly put you in control over your financial future.

Infinite Financial needs you to have your monetary future. For goal-oriented people, it can be the ideal financial device ever before. Right here are the advantages of Infinite Financial: Probably the solitary most useful element of Infinite Banking is that it boosts your cash circulation.

Dividend-paying whole life insurance coverage is extremely reduced danger and offers you, the insurance policy holder, an excellent deal of control. The control that Infinite Financial provides can best be organized into 2 groups: tax advantages and property protections.

Life Insurance Be Your Own Bank

When you utilize entire life insurance for Infinite Banking, you enter right into a private contract in between you and your insurance coverage business. These protections may vary from state to state, they can consist of protection from asset searches and seizures, protection from judgements and security from lenders.

Entire life insurance coverage plans are non-correlated properties. This is why they function so well as the monetary structure of Infinite Financial. Regardless of what takes place in the market (supply, genuine estate, or otherwise), your insurance plan preserves its worth.

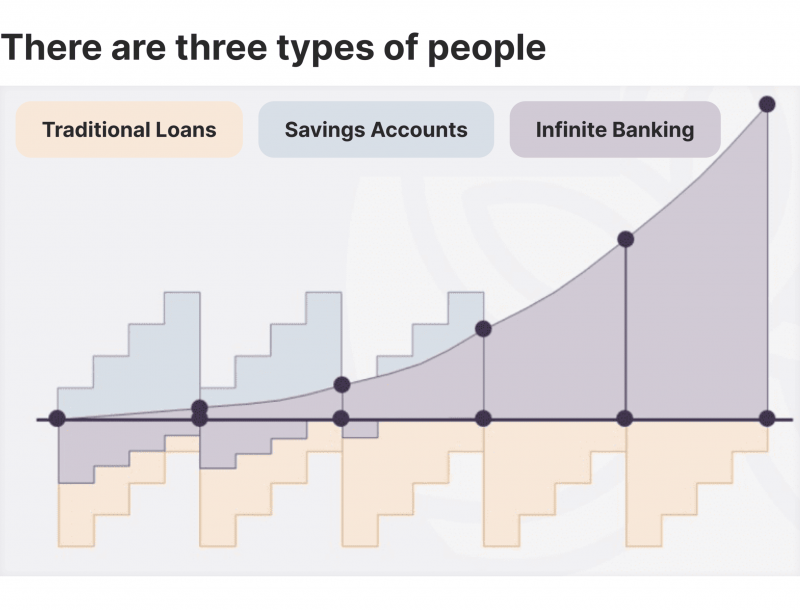

Market-based financial investments grow riches much quicker yet are revealed to market variations, making them inherently high-risk. What happens if there were a third container that supplied security yet also modest, guaranteed returns? Whole life insurance is that 3rd container. Not just is the rate of return on your whole life insurance coverage policy guaranteed, your survivor benefit and premiums are additionally guaranteed.

Here are its main advantages: Liquidity and access: Plan finances provide immediate access to funds without the restrictions of typical financial institution loans. Tax effectiveness: The cash money value grows tax-deferred, and plan car loans are tax-free, making it a tax-efficient tool for constructing riches.

Ibc Personal Banking

Possession protection: In lots of states, the cash worth of life insurance policy is safeguarded from lenders, including an extra layer of financial safety. While Infinite Financial has its merits, it isn't a one-size-fits-all solution, and it features substantial downsides. Below's why it might not be the most effective method: Infinite Banking commonly calls for complex plan structuring, which can puzzle insurance policy holders.

Visualize never having to worry about financial institution financings or high interest rates once again. That's the power of infinite banking life insurance coverage.

There's no collection car loan term, and you have the flexibility to pick the payment timetable, which can be as leisurely as repaying the lending at the time of fatality. This versatility includes the servicing of the lendings, where you can select interest-only payments, keeping the loan equilibrium flat and workable.

Holding money in an IUL dealt with account being credited interest can commonly be far better than holding the cash money on deposit at a bank.: You've constantly imagined opening your own bakery. You can borrow from your IUL plan to cover the initial costs of renting out an area, buying tools, and working with personnel.

The Infinite Banking System

Individual finances can be obtained from typical financial institutions and cooperative credit union. Below are some bottom lines to take into consideration. Charge card can supply an adaptable means to borrow cash for really short-term periods. Nevertheless, obtaining money on a credit rating card is typically extremely costly with yearly percent rates of rate of interest (APR) frequently getting to 20% to 30% or even more a year.

The tax therapy of policy finances can vary significantly relying on your country of home and the details terms of your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy loans are normally tax-free, offering a considerable advantage. Nevertheless, in various other jurisdictions, there may be tax obligation ramifications to think about, such as prospective tax obligations on the loan.

Term life insurance policy just provides a survivor benefit, with no cash money value buildup. This implies there's no cash money worth to obtain against. This post is authored by Carlton Crabbe, President of Resources forever, a specialist in supplying indexed universal life insurance policy accounts. The information provided in this post is for educational and educational purposes only and should not be taken as monetary or investment suggestions.

Nonetheless, for loan officers, the substantial regulations imposed by the CFPB can be viewed as troublesome and restrictive. Loan police officers typically argue that the CFPB's regulations develop unneeded red tape, leading to more paperwork and slower car loan processing. Policies like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) demands, while targeted at securing consumers, can bring about hold-ups in closing deals and enhanced functional expenses.

Table of Contents

Latest Posts

Ibc Be Your Own Bank

How To Create Your Own Bank

Is Infinite Banking A Scam

More

Latest Posts

Ibc Be Your Own Bank

How To Create Your Own Bank

Is Infinite Banking A Scam